Investment Management

Six Sigma Asset Management employs one major portfolio management principle – we aim to improve returns by reducing exposure to high risk (“Six Sigma” ) market events which destroy capital.

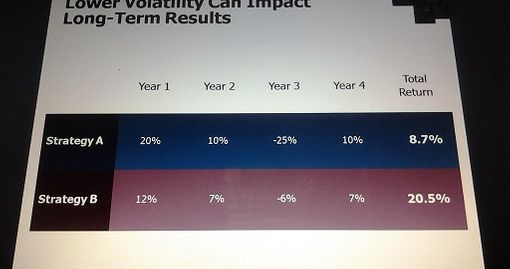

We have this as our focus because we understand a very powerful mathematical concept which we call “Strategy B” *.

As illustrated in the chart below, under Six Sigma Wealth Advisors Strategy B , “Lower Volatility Can Impact Long-Term Results” *, Strategy B demonstrates that in the medium to long term avoiding large draw-downs is much more important to building portfolio value than achieving large gains. The clear winning strategy is to avoid large losses and aim for the steady accumulation of more modest gains.

Six Sigma Wealth Advisors Strategy B

Interactive Brokers, LLC

Securities transactions are generally executed through Interactive Brokers LLC (“Interactive Brokers”, or “Interactive”, or “IB”), which is an SEC-registered broker-dealer, FINRA member and member of SIPC that provides a global online trading platform. Interactive Brokers maintains custody of our clients’ assets and executes and clears customer trades. Six Sigma Wealth Advisors, LLC is independently owned and operated, and is not affiliated with or a related person of Interactive Brokers, and does not receive any compensation from Interactive for directing client funds for custody or trade execution.

Interactive Brokers LLC is a registered Broker-Dealer, Futures Commission Merchant and Forex Dealer Member, regulated by the U.S. Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), and is a member of the Financial Industry Regulatory Authority (FINRA) and several other self-regulatory organizations. Interactive Brokers does not endorse or recommend any introducing brokers, third-party financial advisors or hedge funds, including Cutting Edge Commodities, LLC. Interactive Brokers provides execution and clearing services to customers. None of the information contained herein constitutes a recommendation, offer, or solicitation of an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Interactive Brokers makes no representation, and assumes no liability to the accuracy or completeness of the information provided on this website. For more information regarding Interactive Brokers, please visit www.interactivebrokers.com.

* Weatherstone

Full Service Focus on Asset Protection

The protection of our client’s assets is our first priority. This includes anticipating threats to loss of capital, not just from market price fluctuations, but from risks posed from the potential financial instability or policies of market makers, market providers, and custodians.

For instance, some large custodians/asset managers have a policy of automatically rejecting the execution of orders placed in volatile market conditions, even from Registered Investment Advisors acting on behalf of their clients. https://www.zerohedge.com/news/2018-02-05/roboadvisors-wealthfront-and-betterment-locked-thousands-out-their-portfolios

“According to Bloomberg, back during the Brexit fallout in 2016, Betterment told users that it had implemented a “short delay in trading” to protect its users from a “potentially erratic market.”

We believe that it is solely your/our decision whether or not you wish to sell (or buy) in a steeply declining market.

We believe that stop-loss orders should provide a sufficient range of execution parameters so that you may select parameters which prevent your orders from being subject to manipulation by market makers which can severely affect the profitability of your closing trades. Not all custodians provide such options for stop-loss orders.

We believe you should have access to a short term cash reserve option that does not subject your cash reserve shares to fluctuation in net asset value (price). Not all custodians (some Annuity Insurance Companies, for instance) provide such an option for short term cash reserves.

Many Brokerage firms sell your order flow to High Frequency Trading Firms where that information is used to make money for them by front -running your trades. In our view such profiteering is a betrayal of customer trust. Accordingly, we would never engage in it, but were we to do so it also would be a violation of our fiduciary duty to place your interests ahead of our own.

To the extent possible, we associate only with custodians and trading entities which meet our stringent criteria in order to mitigate these and other such risks to your capital. Interactive Brokers LLC meets – and exceeds – those criteria.

Policies and/or procedures can change rapidly; we endeavor to keep current with such changes and make alterations as quickly as is consistent with your other goals.

Interactive Brokers, LLC

Learn about Interactive Broker’s industry-leading commitment to Customer Asset Protection here.

Customer securities accounts at Interactive Brokers LLC are protected by the Securities Investor Protection Corporation (“SIPC”) for a maximum coverage of $500,000 (with a cash sublimit of $250,000) and under Interactive Brokers LLC’s excess SIPC policy with certain underwriters at Lloyd’s of London 1 for up to an additional $30 million (with a cash sublimit of $900,000) subject to an aggregate limit of $150 million. Futures and options on futures are not covered. As with all securities firms, this coverage provides protection against failure of a broker-dealer, not against loss of market value of securities. For the purpose of determining an Interactive Brokers LLC customer account, accounts with like names and titles (e.g. John and Jane Smith and Jane and John Smith) are combined, but accounts with different titles are not (e.g. Individual/John Smith and IRA/John Smith). SIPC is a non-profit, membership corporation funded by broker-dealers that are members of SIPC. For more information about SIPC and answers to frequently asked questions (such as how SIPC works, what is protected, how to file a claim, etc.), please refer to the following websites: http://www.SIPC.org

Insured Bank Deposit Sweep Program

Under the Insured Bank Deposit Sweep Program, eligible IB clients can obtain up to $2,500,000 of FDIC insurance in addition to the existing $250,000 SIPC coverage for total coverage of $2,750,000. IB sweeps each participating client’s free credit balances daily to one or more banks, up to $246,500 per bank, allowing for the accrual of interest and keeping within the FDIC protected threshold. Cash balances above $2,750,000 remain subject to safeguarding under the SEC’s Customer Protection Rule 15c3-3, backed by the firm’s equity capital, which exceeds $6 billion. Click below for more information about the Insured Bank Deposit Sweep Program and its benefits.